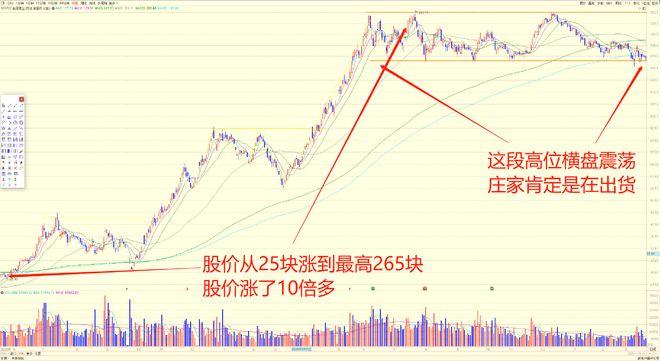

底部是横盘的股票叫什么

Regardless of the strategy employed, risk management is paramount when trading in sideways markets. Consider the following:

While sideways trading can be frustrating, it also presents opportunities for astute traders. Here are some strategies to consider:

Sideways trading can test the patience and discipline of even the most seasoned traders. However, with a solid understanding of market dynamics and the right strategies in place, it's possible to navigate these phases profitably. Remember to stay disciplined, manage risk effectively, and adapt your approach as market conditions evolve.

- Stoploss Orders: Set appropriate stoploss levels to limit potential losses if the trade goes against you.

- Position Sizing: Avoid overcommitting to any single trade, especially in uncertain market conditions.

Sideways trading occurs when a stock's price moves within a relatively narrow range over a period of time, without establishing a clear trend in either direction. During these phases, the market is typically in equilibrium, with buying and selling pressure roughly balanced.

2. Volatility Plays:

During periods of sideways trading, volatility often contracts. Traders can use options strategies such as straddles or strangles to profit from an anticipated increase in volatility when the stock eventually breaks out of the range.

When it comes to stock trading, encountering periods of sideways movement, also known as consolidation or trading ranges, is quite common. This phenomenon can be frustrating for investors and traders alike, as it often leads to uncertainty and indecision. However, understanding the dynamics of sideways trading and employing appropriate strategies can help navigate this phase more effectively.

3. Patience and Observation:

Range trading involves buying near the lower end of the trading range and selling near the upper end. Traders can capitalize on the predictable price movements within the range while managing risk with tight stoploss orders.

Title: Understanding and Navigating Sideways Trading in Stocks

4. Fundamental Analysis:

- Market Sentiment: Uncertainty or indecision among investors can lead to sideways movement as buying and selling pressures offset each other.

1. Range Trading:

While technical analysis is commonly used in sideways trading, don't overlook the importance of fundamental analysis. Stocks stuck in a trading range may still have strong underlying fundamentals that could eventually drive a breakout or breakdown.

Not all sideways movements lead to profitable trades. Sometimes, it's best to wait for a clear breakout or breakdown before taking a position. Patience and careful observation of price action and volume can help identify highprobability trading opportunities.

Several factors can contribute to sideways trading:

免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052